December 2025 144 Market Report

Aggregate 144 Market Volume

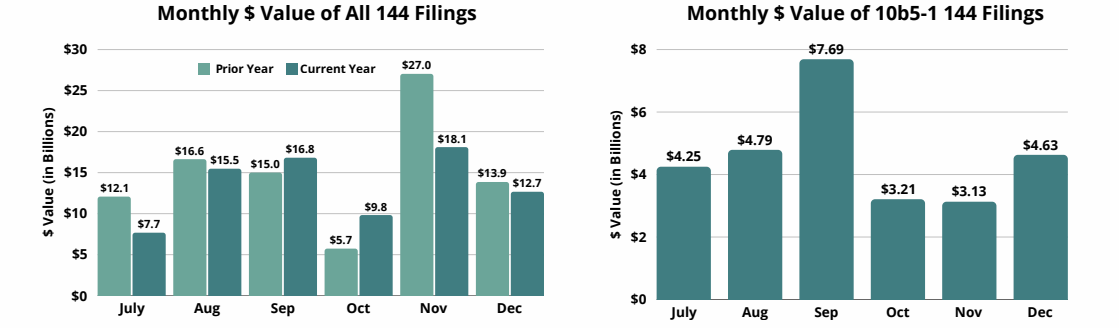

In December 2025, the total reported value of 10b5-1 filings rose 48% from November, accompanied by increases in the number of shares and filings pursuant to a Rule 10b5-1 plan of 131% and 30%, respectively. Conversely, there were month-over-month decreases in the total value, shares registered, and number of filings of discretionary Form 144s. Overall, last month’s fall in non10b5-1 Form 144 activity from the prior month is not unexpected, following typically heightened activity in November. When comparing December 2025 to December 2024, total value of Form 144s decreased 9%, driven primarily by a 17% drop in shares. This year-over-year decline brings December 2025's 144 market metrics in line with prior years, after heavier restricted stock selling activity in 2024.

Top Brokers for December 2025

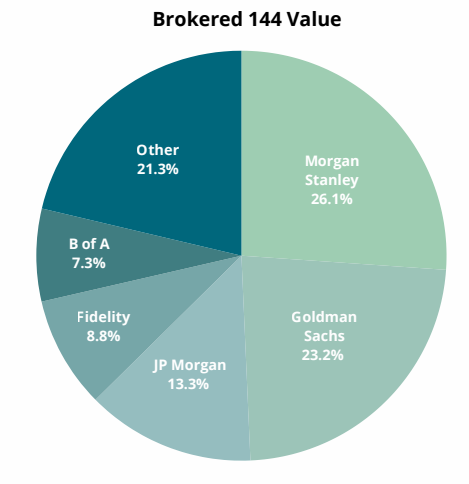

This December, Morgan Stanley reclaimed first place for total value brokered from its second place finish in November. Morgan Stanley also took the top spot for number of filings this past month. Goldman Sachs placed second due in part to brokering two of last month’s largest filings. JP Morgan remained in third by value, while they advanced to first by number of shares. Fidelity claimed fourth place, with Bank of America rounding out December’s top 5 brokers.

Top 144 Filers for December 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| BCPE Watson (DE) BML LP | Coherent Corp - [COHR] | Goldman Sachs | $947.8 |

5.00 |

| LDB C LLC | Apollo Global Management - [APO] | Wells Fargo | $396.2 | 3.00 |

| Walton Family Holdings Trust | Walmart - [WMT] | Goldman Sachs | $380.9 | 3.30 |