November 2025 144 Market Report

Aggregate 144 Market Volume

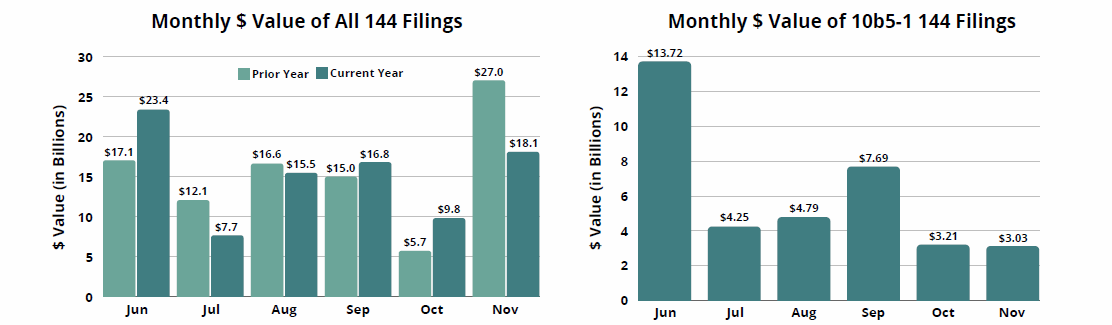

In November 2025, the total reported value of Form 144s surged 84% from October, primarily driven by a 126% increase in the value of discretionary filings. This month-over-month rise in value was also accompanied by an 94% increase in the number of shares registered for sale, and a 58% boost in number of filings. This increase in 144 market volume metrics between October and November is consistent with prior years. In contrast, the total value of 144 filings in November declined 33% from the year prior. This decrease is driven primarily by dramatic dips in the value and shares registered pursuant to Rule 10b5-1, 66% and 60% respectively. The decline in 144 volume metrics this year may suggest a return to normal after the AI-fueled mania in the markets last year.

Top Brokers for November 2025

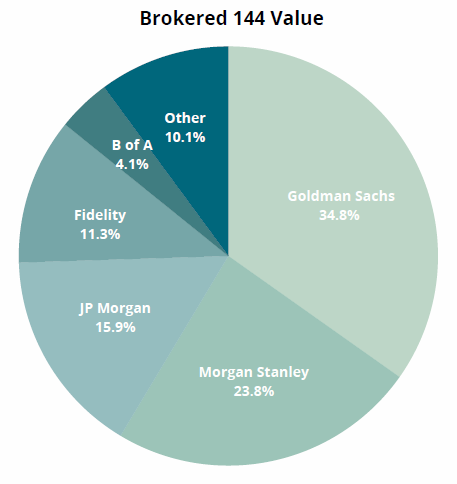

In November, Goldman Sachs advanced to first place in value and shares brokered, due in part to their role in brokering two of last month’s largest 144 filings (see next page). Morgan Stanley fell to second place for value and shares, but held onto first place for number of filings. JP Morgan slid into third place, with Fidelity remaining in fourth place. Bank of America dropped to fifth place from its third place finish in October, rounding out November's top 5 brokers.

Top 144 Filers for November 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Fluor Corp | NuScale Power Corp - [SMR] | Goldman Sachs | $3,601.0 | 110.94 |

| BCPE Watson (DE) BML LP | Coherent Corp - [COHR] | Goldman Sachs | $2,150.6 | 15.00 |

| Lilly Endowment Inc. | Eli Lilly & Co - [LLY] | JPM, Fidelity | $1,977.7 | 2.04 |