September 2025 144 Market Report

Aggregate 144 Market Volume

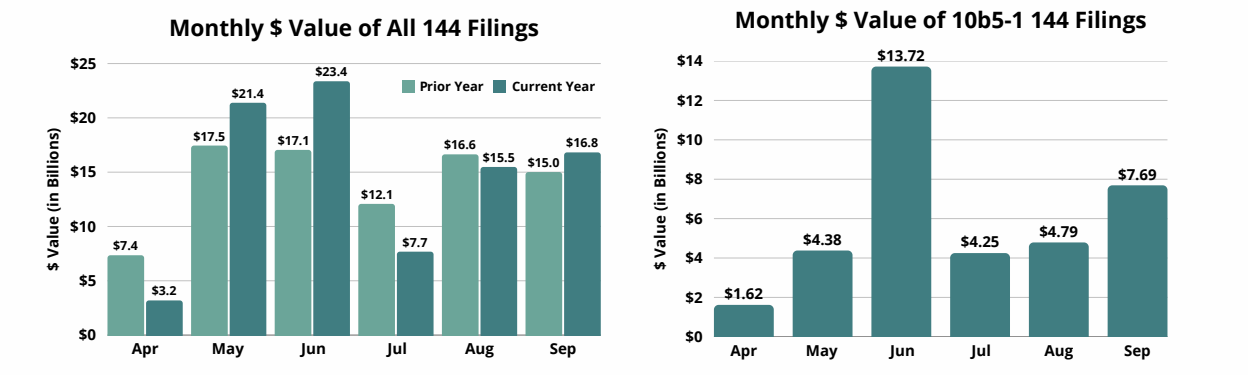

The total reported value of Form 144s rose 9% from August to September, driven by a 32% increase in the number of shares registered for sale. While the value of discretionary filings fell 15%, that was countered by a 61% rise in the value of filings pursuant to Rule 10b5-1. A similar trend was revealed when comparing September 2025 to September 2024; the value of discretionary filings decreased 13% and that of 10b5-1 filings advanced nearly 70%, resulting in a rise in total value of 12%. These metrics may reflect prohibitions during pre-earnings black out periods, at the same time that the market’s new highs trigger the selling instructions of insiders’ 10b5-1 plans.

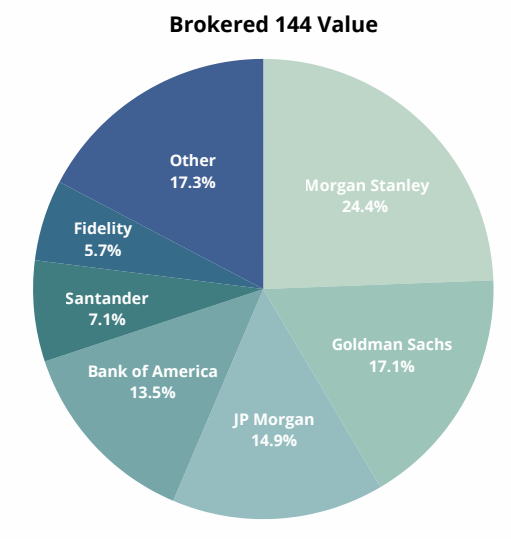

Top 5 Brokers for September 2025

For the fourth month in a row, Morgan Stanley claimed first place across all three metrics: value, shares, and filings. Goldman Sachs rose to second place for value brokered from its third place in August. JP Morgan slid to third, while also taking second for shares brokered. Bank of America advanced to fourth place this September. Newcomer to the Top 5 list Santander rose through the ranks to place fifth for value, due to their role in brokering last month’s largest filing.

Top 144 Filers for September 2025

| Filer | Company | Broker | Value(M) | Shares(M) |

| Deutsche Telekom AG | T-Mobile US - [TMUS] | Santander | $1,201.9 | 5.00* |

| Builders Vision Foundation | Walmart - [WMT] | Goldman Sachs | $606.8 | 5.95 |

| Fluor Corp | NuScale Power Corp - [SMR] | Goldman Sachs | $585.0 | 15.00 |

(*Pursuant to Rule 10b5-1)